The announcement of the break-up of the 2M alliance will certainly lead to a change in the competitive makeup of the deep-sea networks. While the formal break-up will not happen until January 2025, gradual changes are likely during the 2-year transition period. Alan Murphy, CEO, Sea-Intelligence, takes a look at what this means.

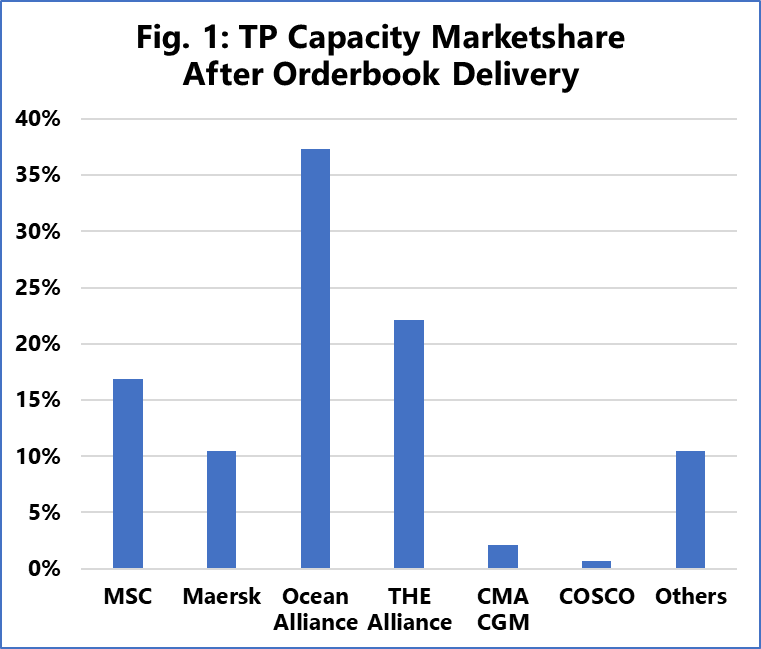

‘In the hypothetical case that the other two alliances remain intact, and that the orderbook gets delivered on time, the changes in the capacity marketshare with a “pure” break-up of 2M on the Transpacific would look like figure 1,’ Murphy explains.

Before we go into that however, the delivery of new vessels is not simply a matter of adding capacity onto a trade, as charter vessels will be returned, ageing vessels will be scrapped, etc. Depending on how these assumptions play out, the outcome can be drastically different.

”Hence, we have elected to create a baseline based on the very simple assumption that carriers in general will take delivery of new vessels, and irrespective of the size of these vessels, will internally cascade capacity between all their global trades, in such a way that the eventual outcome will be an even growth in capacity across their entire operated network,” Murphy continues.

Using this baseline, on the Transpacific as a whole, Maersk will clearly be the smallest of the major carriers and alliances, and with an operated capacity matching the combined niche carriers in the trade. MSC will be stronger positioned compared to Maersk, but still be slightly smaller than THE Alliance, and the Ocean Alliance will be in an extremely strong position in the market. On Asia-Europe, we find essentially the same situation unfold as on the Transpacific, with the only exception being that the small niche carriers play a very marginal role in this trade.