Q&A with Glenn Koepke, GM Network Collaboration at FourKites about supply chain trends 1 year after the Russia – Ukraine War began

It’s now been a full year since Russia’s invasion of the Ukraine and supply chains impacting both countries are still negatively impacted – especially in-and-around the warzone where safe transport is the number-one concern for every member of the supply chain ecosystem.

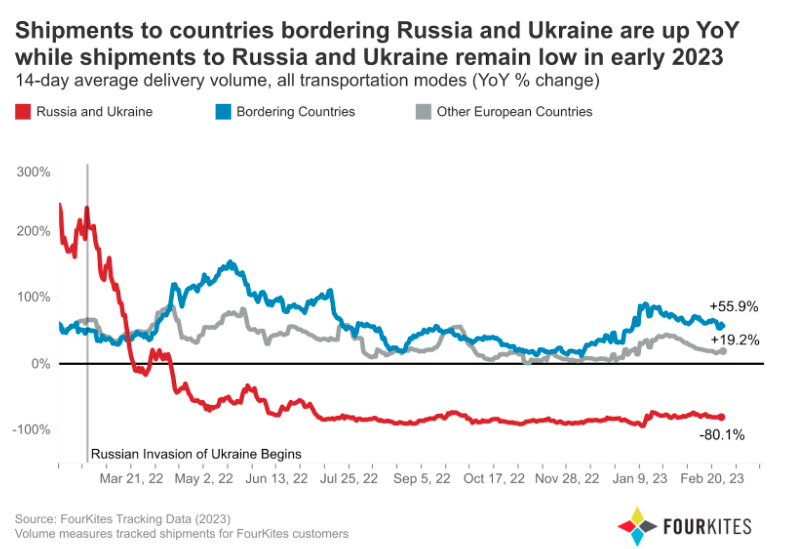

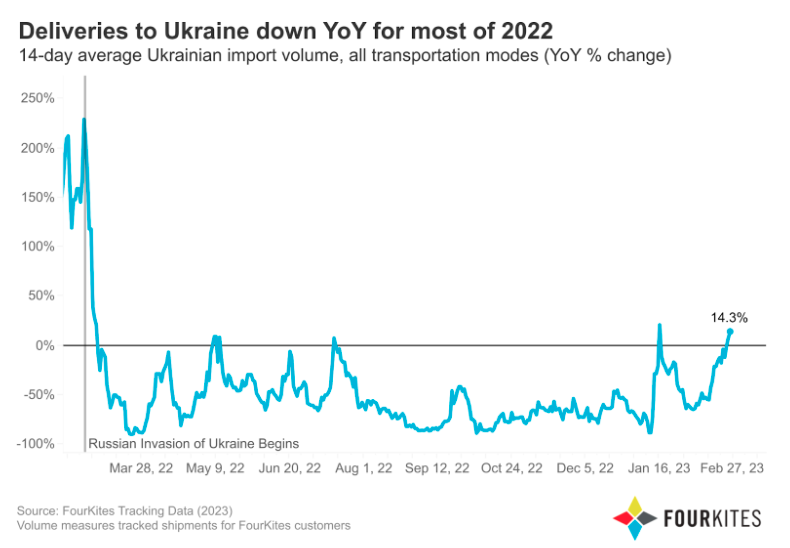

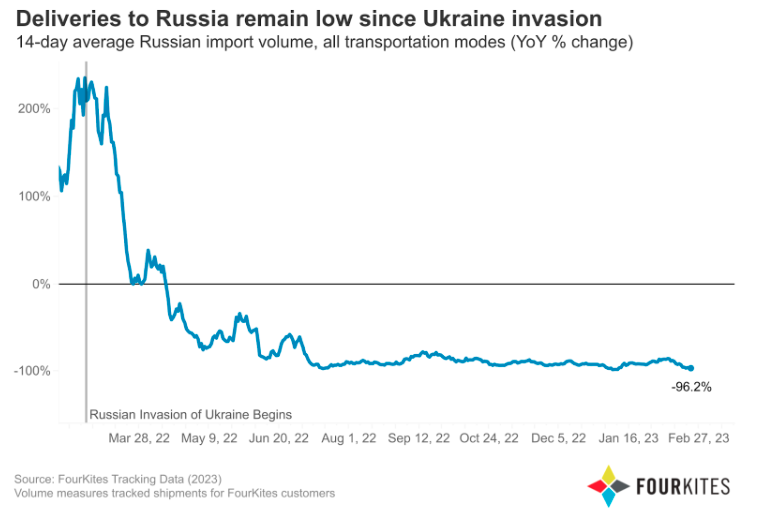

While shipments to Russia and Ukraine were down significantly in 2022, the most recent 14-day average import volumes reveal that Russia’s supply chain is dramatically worsening while Ukraine’s is steadily improving. In fact, YoY, Russia has seen a 96.2 percent drop in import volume YoY while Ukraine’s actually rose 14.3 percent during the same period. An indication that both countries still require the importation of product to sustain their needs and trade flow still occurs, even during a war.

As a result of the war and the dangerous situation it created, most international companies have closed their operations and investments in the region – a massive disruption to the ecosystem that was in-place and a huge void that future generations will need to rebuild post-war. I can recall deploying TMS systems for international companies that had factories and distribution in both Russia and Ukraine and teamwork was highly effective. Sadly, the idea of one team will be very difficult for generations to come, even in a post-war era when decades pass.

In the year ahead, it’s unlikely there is any stability that can be regained but with the given global spotlight now shining on China & Russia and US & Ukraine, supply chains could be in for a major overhaul.

Q1: Do you foresee any permanent changes to global supply chains as a result of the war?

Trade flow for over-the-road and rail cargo between western Europe and Belarus and Russia will have a long-term impact given the sanctions, safety, and political impacts that trade would have. Historically, Russia would allow so many non-Russian licensed drivers in, based on annual permit numbers, but that is no longer a need, and it will likely take decades for international companies to want to pursue and recover business and lost investments in the region.

In addition to trade flow being impacted, routings via vessels will change in the Black Sea. This risk and long-term implications will obviously coincide with the territories that are held, but logistically speaking, the Black Sea is a major strategic corridor for both import and export freight.

The worst-case scenario from a supply chain point of view is if China and the US square off in a trade war. Given China’s production volume and export volume to the rest of the world, this would cause production lines, pricing, and product availability to enter a world we have never seen. With more media attention-grabbing headlines weekly on this topic, ultimately supply chains have to remain global due to the dependencies networks have established over decades. Changing this overnight just isn’t feasible at a global scale.

Q2: How has the changing macro-economic environment (lower demand, more capacity, persistent inflation) changed how shippers approach moving goods in / out / around the warzone?

Safety, risk and exposure are the primary drivers of transport around the warzone and less about demand, capacity and inflation. Although Russia and Ukraine respectively produce specific products and are net exporters in certain commodities, at an overall global level, supply chains have remained resilient, and found alternatives and can sustain for the long term without impact.

Q3: Has anything about the past year (with regards to / related to the war) surprised you? What do you anticipate shippers in the region will face in 2023?

The Black Sea is a critical link for Ukraine to be connected to the global economy and not be a landlocked country dependent on neighboring countries and trade partners to access the global waterways.

One of the saddest effects is that international companies had to leave behind their Russian and Ukrainian businesses, investments and employees due to political and social consequences and the years of teamwork, investment and innovation to get supply chains to be optimal in the region were thrown out in one day and will take generations to recover.

FourKites Data

Following the Russian invasion of Ukraine on February 24, 2022, deliveries to Russia fell and have remained at lows through the new year. The 14-day average Russian import volume has been down year over year since August. Most recently, the 14-day average import volume to Russia was down 96.2% year over year.

On the other hand, deliveries to Ukraine, while still behind from levels before the Russian invasion for most of 2022, have been on the rise in the past month. In the last two weeks, the average volume of imports to Ukraine was up by 14.3% YoY.

FourKites notes that while shipments to both Russia and Ukraine were down YoY for most of 2022, shipments to countries bordering Ukraine and Russia and to other European countries were up YoY.

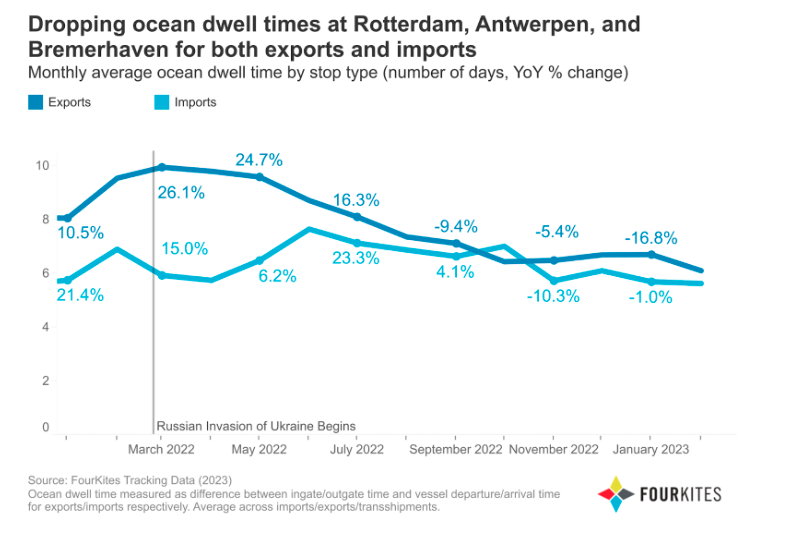

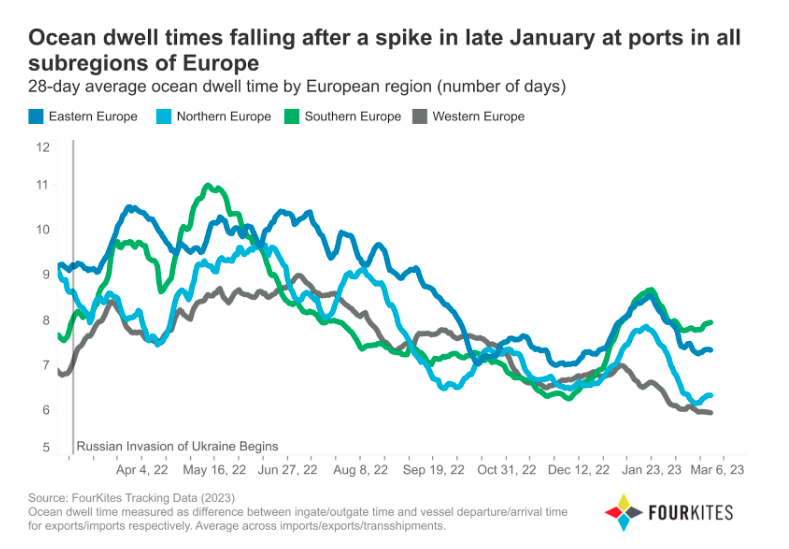

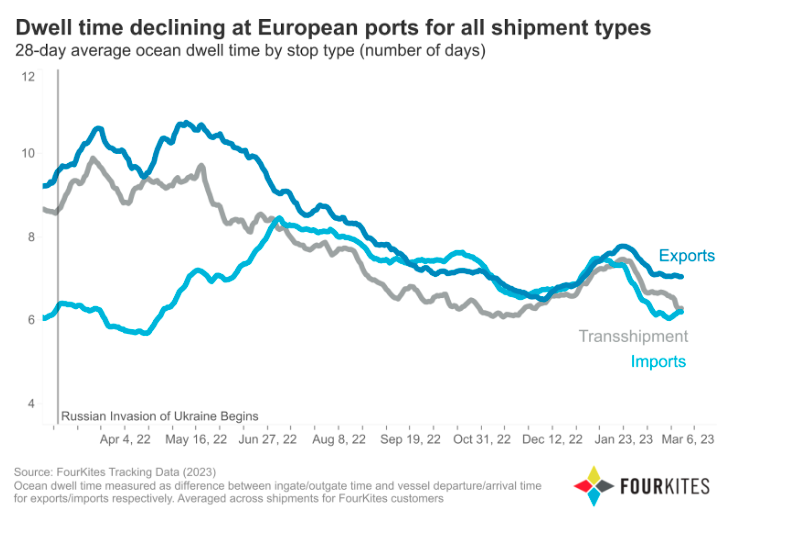

Across the major European ports of Rotterdam, Antwerpen, and Bremerheven, ocean dwell times have dropped since reaching highs in the weeks following the Russian invasion of Ukraine last year. As of February 26, 2023, the average dwell time at Rotterdam, Antwerpen, and Bremerheven was 5.6 days for imports and 6.1 days for exports, down by 18.4% and 36%, respectively, from the monthly average dwell time in February of last year.

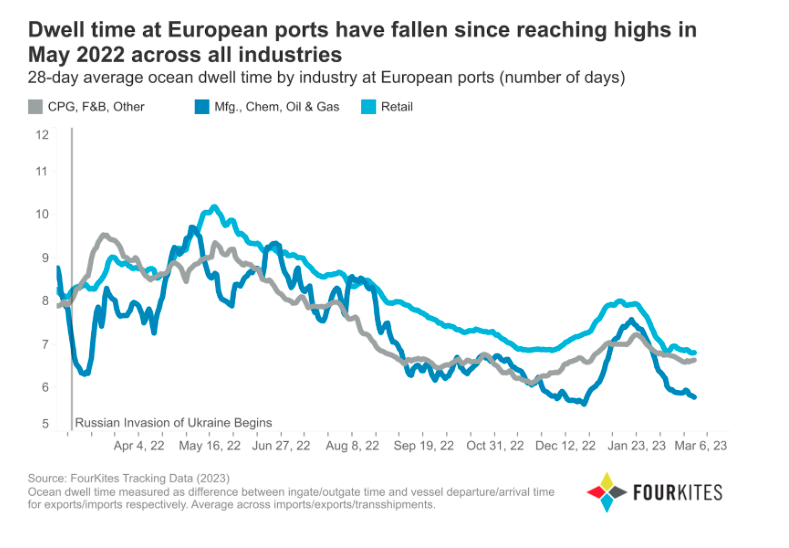

Across all European ports, ocean dwell times have fallen for both exports and transshipments. As of February 26, 2023, the 28-day average ocean dwell times were 7.1 days for exports and 6.3 days for transshipments, which were down by 26.8% and 28.4%, respectively, from last year. For imports, the 28-day average ocean dwell time was slightly up by 3.1% from last year at 6.2 days.