MEWP rental markets continued to recover strongly after the pandemic in 2021 and 2022, despite clouds on the horizon caused by global uncertainty around geo-political upheavals and increased input costs, driven by rising inflation and the war in Ukraine, according to the latest analysis conducted for the International Powered Access Federation (IPAF) by Ducker.

Most markets in Europe, the US and the Middle East continued to recover strongly, though a resurgence of Covid-19 and accompanying lockdowns and restrictions in some parts of China did hamper the recovery there, as well as causing knock-on effects in the supply of Chinese-manufactured MEWPs that were increasingly sought-after during 2021, owing to supply-chain issues affecting many western manufacturers.

The newly published Global Powered Access Rental Market Report 2022 indicates that, after a relatively cautious start to the year in which many countries under study were still dealing with second and third waves of the Covid-19 virus, most MEWP rental companies sought to increase rental fleet size and utilisation rates during 2021; post-pandemic recovery was fairly even worldwide and maintained a steady rate.

Companies returned to planned investment strategies and supply struggled to keep up with demand in terms of new machines, especially specialist and all-electric MEWPs, owing mainly to the “whiplash” effect of the pandemic recovery on fuel prices, energy costs and raw materials. This led to longer lead times on machines and an increased reliance on older or second-hand machines to maintain fleets in line with demand.

This effect can be seen to have continued in the first half of 2022, driven by rising global energy costs, soaring inflation in most developed economies, exacerbated by the knock-on effects of Russia’s invasion of neighbouring Ukraine in February 2022.

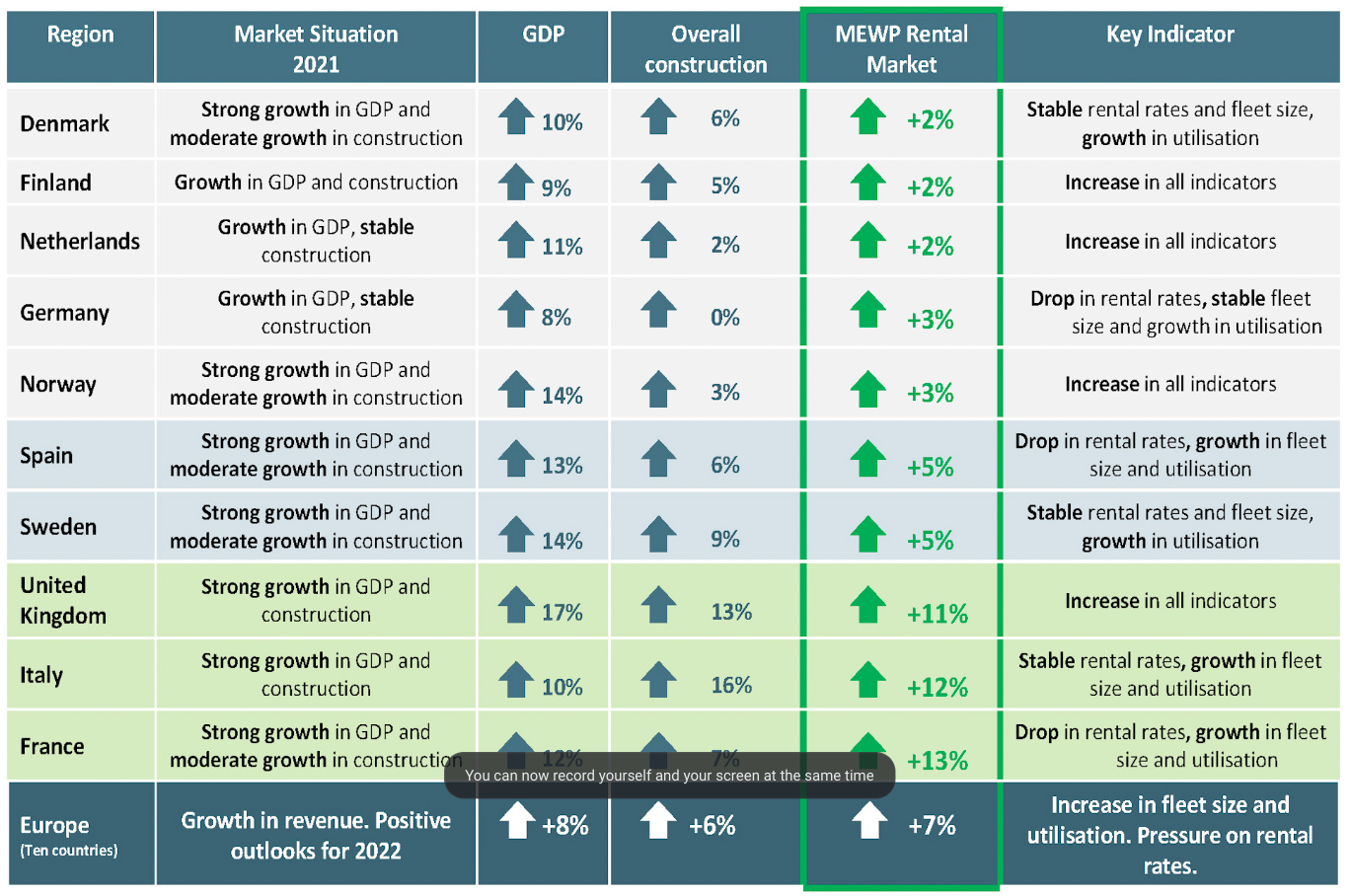

Overall, the report indicates that the European MEWP rental market partially recovered from the pandemic in 2021, and overall showed revenue growth of 7% across 2021. Europe’s rental market reached €3 billion total revenue, to almost regain pre-pandemic levels of activity owing to recovering demand in both construction and non-construction sectors. The European fleet stood at approximately 325,000 units at the end of 2021.

Utilisation rate went up by 6 percentage points, driven by the post-pandemic recovery and ongoing OEM MEWP shortages and supply issues. Countries such as the UK (11% revenue growth), Italy (12%) and France (13%) that were hit hardest in Europe during 2020 demonstrated the fastest rates of recovery.

Elsewhere in Europe the recovery was more modest, inversely proportionate to the severity at which markets were affected in the first peaks of the pandemic: Spain and Sweden saw revenue growth in 2021 of 5%; Germany and Norway 3%; Denmark, Finland and the Netherlands all saw growth of just 2%. By contrast the US market rebounded to grow by 15%, though this reflects both the significant hit the market took in 2021 and the fiscal recovery package unveiled by incoming US President Joe Biden.

On the back of the strongest revenue growth of the European countries under study, France recovered its position as having Europe’s largest MEWP fleet. Germany crept ahead of France and the UK in terms of overall fleet size at the end of 2020, but a strong year saw France increase its fleet to more than 62,000 at the end of 2021, compared with just over 60,000 units in Germany and 58,000 in the total UK fleet.

The transition to “greener” electric and hybrid machines continues strongly in all European countries, albeit hampered by a lack of availability of new machines. Electric scissors are dominant in all countries, particularly the Netherlands, Nordics and Germany. The transition to electric scissors continues in the rest of Europe, but diesel scissors are still used for outdoor applications in most countries. European rental companies expect to complete the transition to a “green” fleet in 5-10 years.

In the US, MEWP rental revenue increased by 15% across 2021 to surpass pre-pandemic levels, owing to rapid reopening of non-construction business and pent-up demand from construction projects paused during 2020. With President Joe Biden being inaugurated in early 2021, the vaccine roll-out and post-pandemic recovery stimulus were instrumental in rebuilding confidence and rebounding activity in the US.

As well as revenue growth (driven in part by increased rental rates and rising demand for MEWPs), MEWP fleet size in the US grew by 10% in 2021, as rental companies resumed their pre-pandemic investment strategies and attempted to prevent utilisation rates from increasing extensively.

Overall US fleet growth was hampered by supply chain disruptions, as in other western markets, though the US as a whole was able to increase fleet size by more than 60,000 units, to stand at 722,105 by the end of 2021. This growth is forecast to continue in 2022 but may be inhibited by inflationary pressures on the economy and trade issues, including a prohibitive tariff ruling on Chinese MEWP imports announced in 2021.

As in Europe, typical power source types continued progressing towards hybrid or all-electric machines during the year, albeit at a slower pace than in European markets. In the US, electric booms are not so in demand, not only because of limited autonomy and charging infrastructure issues, but also because of climatic constraints that prevent the use of electric equipment outdoors during certain months in parts of the US.

As in 2021, the 2022 report also contains a special market focus on China and on the Middle East Gulf Co-operation Council (GCC) countries of Saudi Arabia, UAE and Qatar. The China report paints a picture of a MEWP rental market still growing at unprecedented speed despite the pandemic – Chinese MEWP rental market growth remained strong (47%) in 2021, driven mainly by fleet expansion. However, uncertainty around continued outbreaks in key cities in China limited market optimism, with forecast annual revenue growth of 10% in 2022, and 6% in 2023.

In terms of total fleet size, this continued expanding at a remarkable rate in China: The estimated total MEWP rental fleet expanded rapidly in 2021, reaching almost 330,000 units in total. Total fleet size is forecast to stand around 435,000 to 440,000 at the end of 2022. After years of rapid growth, more moderate – but still double-digit – fleet growth is expected from 2023 onwards. Will China’s rental fleet one day exceed that of the US at some point in the next five years? At this rate, it is impossible to rule out.

The picture was largely positive in the Middle East, with recovery tracking the higher end of European or the US market. On average across the three countries under study revenue grew by 13% – compared with 13% for France and 15% for the US. Total rental revenue recovered from the lows of the pandemic in all three countries, with combined annual revenue reaching $146 million, driven by infrastructure investment in the region and business generated by the Dubai Expo trade fair held in Q4 2021.

In 2021, the total fleet size in the three Middle East countries under study grew by around 2%, owing to rental companies increasing their fleets to pre-pandemic levels to keep pace with the recovering demand. In 2022, respondents expected to continue buying machines, increasingly turning to Chinese MEWP manufacturers.

While diesel-powered booms still represent the bulk of the MEWP fleet in all three countries, the share of electric-powered equipment is expected to grow – especially in the UAE, less so in Saudi Arabia – as end-use pivots towards facilities management and there is an increased focus on workplace safety and occupational health, seeing scaffolding phased out in favour of electric scissors on internal maintenance and fit-out.

In summary, fleet sizes and rental revenue are increasing in all markets under study, investment confidence has returned, the pivot towards electric-powered machines continues apace and even well-documented supply-chain issues cannot dampen optimism. While there are clouds of uncertainty on the horizon, the outlook remains bright for the global powered access rental industry for the foreseeable future.