Towards the end of 2023, following the commencement of the Israel-Hamas war, the Yemen-based Houthi group launched several attacks on commercial ships at the southern end of the Red Sea. These attacks have escalated since November 2023 and continued into the new year, representing a major concern for global trade as 10-15 per cent of this passes through the Suez Canal – a sea-level waterway which connects the Red Sea to the Mediterranean Sea. Ritesh Kumar, director, procurement and supply chain intelligence at The Smart Cube, shares some thoughts on the situation.

How are the events impacting supply chains?

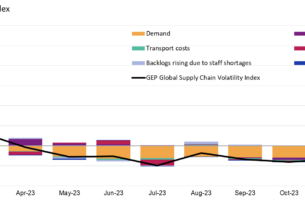

As a result of the attacks, shipping disruptions in the global market have emerged. Shipping companies have paused transportation through the Red Sea, instead choosing to take a longer route around the Cape of Good Hope and West Africa. This journey adds 3500 nautical miles to the shipments, causing shipment delays of between seven and 10 days.

What’s more, freight costs have risen sharply since the Red Sea attacks began. For example, the spot rates of containers on the China to Mediterranean route have risen by more than 70 per cent following the shipping disruption and subsequent rerouting of vessels. This will have a financial impact on organisations as it will add significant costs to their supply chains.

In the short term, the price of various commodities is likely to be impacted by the disruption. This includes oil, with the Red Sea being one of the world’s most important routes for oil shipments. Around 9.2 million barrels of oil per day were shipped through the Suez Canal in the first half of 2023, representing roughly 9 per cent of global oil demand. With the disruption and redirection of vessels continuing, this will cause a delay in the shipment of oil, which is expected to lead to a rise in the commodity’s price.

What would the impact on the EU and the UK economy be?

Trade disruption in the Red Sea region caused by Houthi attacks on container ships has already started impacting businesses in the EU and the UK. The immediate disruption is causing shipping companies to reroute their EU/UK bound shipments from Asia and the Middle East through the Cape of Good Hope, South Africa.

This longer shipping route has led to increased lead times, higher freight costs, escalated shipping surcharges and reduced container availability due to containers taking longer to pick up their next cargo. This is causing inventory levels to dwindle, raw material shortages and production disruption across sectors including automotives, ICT, chemicals, and retail.

For instance, Europe is a key importer of electronic components from Asia; several consumer goods, including PC and electronics shipments to Europe, are likely to be adversely impacted by the ongoing attacks on shipping containers in the Red Sea. The European automotive industry is also heavily reliant on the supply of essential components from Asia. Around 70 per cent of components in the European automotive sector pass through the Red Sea waters from Asia. Potential delays in shipping schedules have forced several automotive and ancillary equipment manufacturers such as Tesla, Volvo and Michelin (tyres) to announce pauses in production.

These developments have started to disrupt trade from APAC and the Middle East to European countries such as the UK, Germany, Denmark and the Netherlands. Businesses have even started revising their Q1 targets in view of these disruptions. The situation warrants close monitoring over the coming weeks.

What can companies do to mitigate any negative effects?

To mitigate supply chain disruptions during the Red Sea shipping crisis, companies must adopt a multipronged strategy. Firstly, supply chain professionals should evaluate multiple suppliers and support their critical vendors. This can be done by identifying suppliers in several different geographies to reduce dependency on a single provider and territory, especially if a company is purchasing from areas impacted by the ongoing crisis.

Secondly, organisations ought to continually monitor the situation as it continues to evolve. Regarding the current events in the Red Sea, category managers need to monitor its progress and assess its potential consequences on key geographies and suppliers.

Finally, companies must improve inventory and labour planning to mitigate the impact of potential shipping disruptions. This necessitates carrying out detailed assessments to evaluate the required levels of inventory, as well as ensuring that the necessary inventories are in place in case of delays or disruptions to supply.